When it comes to property investment in Malaysia, there are two primary options to consider: residential and commercial properties. As a property investment specialist focused on generating passive income, it is crucial to understand the fundamental differences and potential benefits of each type of investment. This article aims to provide a comprehensive analysis of residential and commercial property investment in Malaysia, covering various factors such as rental yields, market trends, property management, and potential risks. By delving into the nuances of these investment options, you will gain valuable insights that can assist you in making informed decisions and maximizing your returns in the Malaysian property market.

Residential Property Investment in Malaysia

Overview of the Residential Property Market in Malaysia

The residential property market in Malaysia has experienced significant growth in recent years, making it an attractive option for investors seeking to generate passive income. With an increasing population and a strong demand for housing, residential properties offer stable returns and potential capital appreciation.

According to recent statistics, the residential property market in Malaysia has shown consistent growth, driven by factors such as urbanization, rising incomes, and favorable government policies. The market offers a range of options, from affordable housing to luxury condominiums, catering to various investor preferences and budgetary constraints.

Advantages of Investing in Residential Properties

Investing in residential properties in Malaysia can bring several advantages for investors. Firstly, residential properties offer a steady source of passive income through rental yields. With the high demand for housing in urban areas, rental rates remain stable, ensuring a consistent flow of rental income.

Moreover, residential properties provide an opportunity for capital appreciation. As population and urbanization continue to increase in Malaysia, the value of residential properties is expected to rise over time. This appreciation allows investors to benefit from both rental income and potential profits upon selling the property in the future.

Another advantage of residential property investment is the possibility of diversification. By investing in multiple residential properties across different locations, investors can spread their risk and mitigate the impact of fluctuations in the property market.

Disadvantages of Investing in Residential Properties

While residential property investment offers many advantages, there are also certain disadvantages that investors should be aware of. One potential drawback is the need for ongoing maintenance and management of the properties. This involves regular inspections, repairs, and dealing with tenants, which can be time-consuming and require additional resources.

Furthermore, residential property investment is subject to market fluctuations. Economic conditions, government policies, and changes in housing demand can impact the value of residential properties. Investors must carefully assess market conditions and be prepared for potential fluctuations in rental rates and property prices.

Additionally, residential properties may face higher vacancy rates compared to commercial properties. Tenant turnover and vacant periods can result in temporary loss of rental income, affecting the overall returns on investment.

Factors to Consider when Investing in Residential Properties

Before making any investment decisions, it is crucial to consider several factors that can impact the success of residential property investment in Malaysia.

Location is one of the most critical factors to consider. Investing in properties located in prime areas with high demand, proximity to amenities, and good infrastructure can maximize rental yield and potential capital appreciation. Additionally, properties near educational institutions, business districts, and transportation hubs are likely to attract a larger pool of tenants.

Market conditions also play a significant role. Understanding the supply and demand dynamics in the residential property market is essential for making informed investment decisions. Researching local market trends, vacancy rates, and rental yields can provide valuable insights into the market’s performance and growth potential.

Furthermore, investors should consider their budget and financial goals. Determining the affordability of the investment, calculating the expected returns, and setting realistic financial objectives are crucial steps in the decision-making process.

Popular Residential Property Investment Strategies

Investors can adopt various strategies when investing in residential properties in Malaysia. One common strategy is buy-to-let, where investors purchase residential properties with the intention of renting them out for steady rental income. This strategy is suitable for long-term investors looking for passive income streams.

Another popular strategy is flipping properties. This involves buying residential properties at a lower price, renovating or improving them, and selling for a higher price to make a profit. Flipping can be a more short-term investment approach, but it requires careful market analysis and a good understanding of property valuation.

Additionally, investors can consider investing in residential real estate investment trusts (REITs). REITs allow investors to own a diversified portfolio of residential properties without the need for direct property ownership. This strategy provides liquidity and flexibility while still offering potential returns.

Tips for Successful Residential Property Investment

To increase the chances of successful residential property investment in Malaysia, here are some tips that investors should consider:

- Thoroughly research the market and conduct due diligence before making any investment decisions.

- Seek professional advice from real estate agents, property investment specialists, and financial advisors.

- Take into account the potential risks, such as changes in government regulations or unforeseen economic downturns.

- Consider the long-term prospects and sustainability of the investment.

- Regularly review and monitor the performance of the investment to make necessary adjustments.

Legal Considerations for Residential Property Investment

Investing in residential properties in Malaysia requires adherence to specific legal considerations. Some important legal aspects to consider include:

- Understanding property ownership rights and regulations, including foreign ownership restrictions.

- Complying with relevant property laws and regulations, such as obtaining the necessary permits and licenses.

- Familiarizing oneself with taxes and regulations related to property transactions, rental income, and capital gains.

Engaging the services of professional lawyers and consultants is advisable to ensure compliance with legal requirements and protect the integrity of the investment.

Financing Options for Residential Property Investment

Financing residential property investment in Malaysia can be done through various options, including:

- Mortgage loans: Banks and financial institutions in Malaysia offer mortgage loans with competitive interest rates and flexible repayment terms.

- Joint ventures: Investors can collaborate with partners to pool financial resources and share the investment risk.

- Government schemes: The Malaysian government provides various initiatives and assistance programs to support affordable housing and property ownership.

It is essential to assess the financing options available, compare interest rates, and consider one’s financial capabilities before committing to any loan agreements.

Risks and Challenges in Residential Property Investment

While residential property investment holds great potential, there are inherent risks and challenges that investors must be prepared to face. Some of these include:

- Market volatility: Fluctuations in property prices and rental rates can impact investment returns.

- Economic downturns: Recessionary periods can result in decreased demand for rental properties and lower rental yields.

- Maintenance and management: Ongoing maintenance costs and tenant management can be demanding and time-consuming.

- Regulatory changes: Changes in government policies, tax regulations, or housing laws can impact investment strategies and returns.

Being proactive in managing these risks and staying updated with market conditions can help investors navigate challenges successfully.

Case Studies of Successful Residential Property Investments

To illustrate the potential success of residential property investment in Malaysia, here are two case studies:

-

Case Study 1: Investor A purchased a condominium in a highly sought-after location near a university. Through diligent market research and proper maintenance, the property achieved a high occupancy rate, resulting in steady rental income. Over time, the property’s value increased significantly, allowing Investor A to sell the property at a substantial profit.

-

Case Study 2: Investor B invested in a portfolio of affordable housing units across various regions in Malaysia. By targeting areas with high demand and capitalizing on government initiatives for affordable housing, Investor B achieved consistent rental income. Moreover, due to the sustained growth in the property market, the value of the portfolio increased considerably, enhancing the overall return on investment.

These case studies highlight the potential rewards of well-planned residential property investment strategies and the importance of market knowledge and the ability to adapt to changing conditions.

In conclusion, residential property investment in Malaysia offers investors a promising opportunity for generating passive income and achieving long-term capital appreciation. By thoroughly researching the market, considering key factors, and adopting suitable investment strategies, investors can maximize their chances of success. However, it is crucial to understand and manage the associated risks and challenges while complying with legal requirements. With careful planning and informed decision-making, residential property investment can be a lucrative venture in the Malaysian market.

Commercial Property Investment in Malaysia

Overview of the Commercial Property Market in Malaysia

The commercial property market in Malaysia presents a compelling investment opportunity for investors seeking to diversify their portfolios and generate significant returns. Commercial properties, such as office buildings, retail spaces, and industrial facilities, offer distinct advantages and potential for capital appreciation.

Malaysia’s commercial property market has experienced steady growth in recent years, driven by factors such as economic development, urbanization, and foreign investments. The demand for commercial spaces, particularly in key business districts, has been on the rise, creating favorable conditions for investors in this sector.

Advantages of Investing in Commercial Properties

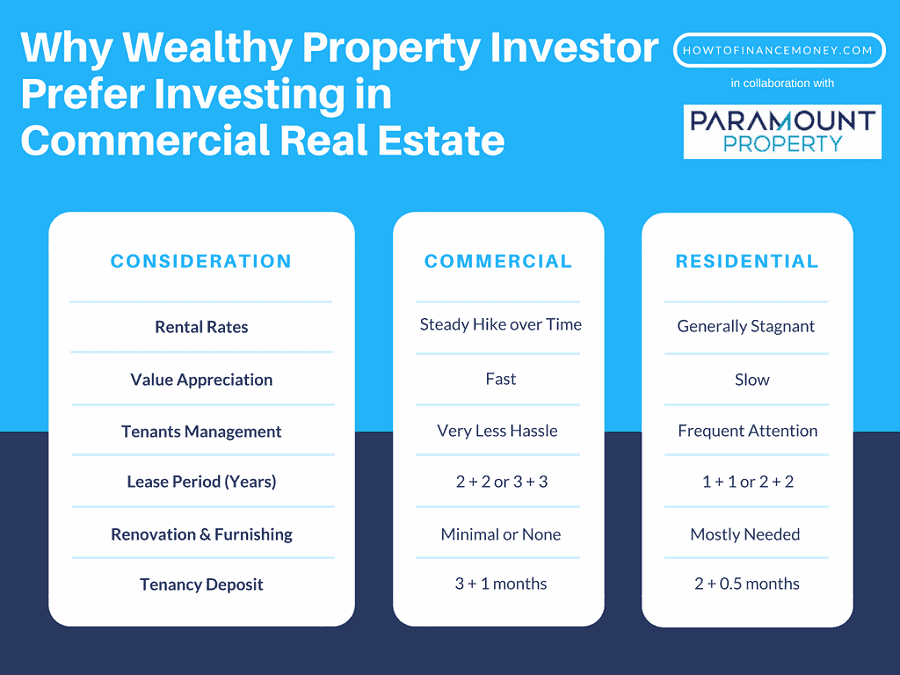

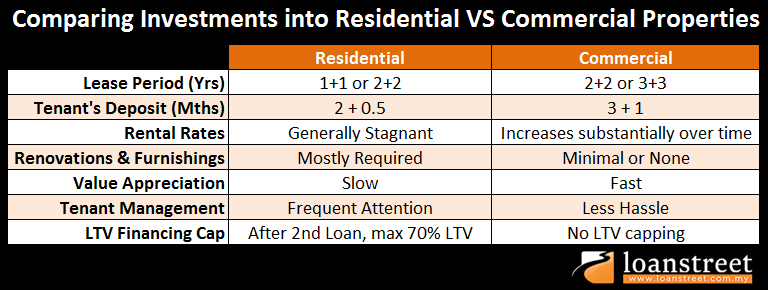

Investing in commercial properties in Malaysia can bring several advantages for investors. Firstly, commercial properties typically offer higher rental yields compared to residential properties. The demand for office spaces, retail outlets, and industrial facilities remains strong, providing a reliable and potentially higher income stream for investors.

Moreover, commercial properties often have longer lease terms, resulting in more stable cash flows. Unlike residential properties where leases are generally shorter, commercial leases can span several years, reducing the risk of frequent tenant turnover and vacancies.

Furthermore, commercial property investments offer the potential for significant capital appreciation. As the economy grows and businesses expand, the value of commercial properties in strategic locations is likely to increase. This appreciation can provide investors with substantial profits upon selling or refinancing the property.

Disadvantages of Investing in Commercial Properties

While commercial property investment offers distinct advantages, there are also certain disadvantages that investors should consider. One significant challenge is the higher entry cost compared to residential properties. Commercial properties generally require larger investments and higher upfront capital, which may pose barriers to entry for some investors.

Additionally, commercial property investments entail a higher level of complexity and risk compared to residential properties. Factors such as lease negotiations, tenant management, and the overall performance of the business sector can significantly impact investment returns. Investors need to possess a deeper understanding of the commercial property market and its dynamics.

Moreover, commercial properties may be more susceptible to economic downturns and changes in the business environment. During periods of recession or market fluctuations, businesses may downsize or struggle, affecting rental demand and potential rental yields.

Factors to Consider when Investing in Commercial Properties

Investing in commercial properties requires careful consideration of several factors that can influence the outcome of the investment. Some key factors to consider include:

-

Location: Choosing strategic locations with high business activity, accessibility, and favorable demographics is crucial for attracting quality tenants and maximizing rental income.

-

Lease terms: Evaluating the terms and conditions of potential leases is essential. Factors such as rent escalations, tenant responsibilities, and lease renewals can impact the stability of rental income.

-

Tenant profile: Analyzing the creditworthiness and reputation of potential tenants is critical. Understanding their business model, financial stability, and industry performance can minimize the risk of tenant defaults.

-

Market demand: Assessing the overall demand for commercial spaces in the target location is important. Factors such as population growth, business expansion plans, and industry trends can influence the long-term viability of the investment.

Popular Commercial Property Investment Strategies

Investors can employ various strategies when investing in commercial properties in Malaysia. Some popular strategies include:

-

Office space investments: Investing in office buildings located in prime business districts can provide a stable and potentially high rental income. This strategy is suitable for investors seeking to tap into the growing demand for quality office spaces.

-

Retail property investments: Investing in retail spaces, including shopping malls or shop lots, allows investors to capitalize on the consumer-driven Malaysian economy. Retail spaces in high-traffic areas or popular tourist destinations can offer substantial rental income and potential capital appreciation.

-

Industrial property investments: Investing in industrial facilities, such as warehouses or manufacturing plants, can be lucrative due to the country’s growing manufacturing sector. Industrial properties located near transportation hubs or industrial parks are attractive to businesses seeking efficient logistics.

Choosing the most suitable investment strategy depends on factors such as investors’ risk tolerance, investment goals, and market analysis.

Tips for Successful Commercial Property Investment

To increase the chances of successful commercial property investment in Malaysia, here are some tips for investors:

-

In-depth market research: Understand the business environment, market trends, and demand dynamics in the target commercial property sector.

-

Engage professionals: Seek advice from commercial real estate agents, property consultants, and legal experts to navigate the complexities of commercial property investment.

-

Financial analysis: Conduct thorough financial assessments, including risk assessments, cash flow projections, and return on investment calculations, to ensure the feasibility of the investment.

-

Long-term perspective: Commercial property investment is often a long-term commitment. Consider the potential for capital appreciation, rental income growth, and the overall sustainability of the investment.

Legal Considerations for Commercial Property Investment

Investing in commercial properties in Malaysia involves legal considerations similar to residential property investment. Key legal aspects to consider include:

-

Property ownership regulations: Familiarize oneself with the restrictions and regulations on foreign property ownership and land tenure laws.

-

Commercial leases: Understand the legal requirements and considerations for drafting commercial lease agreements, including tenant rights, dispute resolution, and rent review mechanisms.

-

Tax obligations: Be aware of the tax implications related to commercial property investment, such as income tax on rental income and capital gains tax upon property disposal.

Professional legal advice is recommended to navigate the legal landscape and ensure compliance with all relevant laws and regulations.

Financing Options for Commercial Property Investment

Financing commercial property investment can be done through various options, including:

-

Commercial mortgage loans: Banks and financial institutions offer commercial mortgage loans with customized terms and competitive interest rates. These loans are tailored to meet the specific needs of commercial property investors.

-

Joint ventures: Collaborating with partners or forming syndicates can provide access to larger capital resources and spread the risk among multiple investors.

-

Real estate crowdfunding: Crowdfunding platforms allow individuals to invest in commercial properties by pooling funds with other investors. This option provides the opportunity to participate in commercial property investment with lower investment amounts.

Determining the most suitable financing option depends on individual circumstances, investment objectives, and risk tolerance.

Risks and Challenges in Commercial Property Investment

While commercial property investment can be highly rewarding, it is not without risks and challenges. Some key risks and challenges to consider include:

-

Economic conditions: Commercial properties are influenced by economic fluctuations. Economic downturns or changes in business sectors can impact rental demand and overall investment returns.

-

Tenant management: Dealing with commercial tenants can be more complex compared to residential tenants. Negotiating leases, managing tenant relationships, and ensuring regular rental payments require specialized knowledge and skills.

-

Market competition: The commercial property market can be highly competitive, especially in prime areas. Investors need to stay up-to-date with market trends and understand the competitive landscape to identify and secure lucrative investment opportunities.

-

Financing constraints: Financing larger commercial property investments may be more challenging due to stricter lending criteria, higher down payment requirements, and potential interest rate fluctuations.

Navigating these risks and challenges requires a proactive approach, continuous monitoring of market conditions, and access to expert advice.

Case Studies of Successful Commercial Property Investments

To demonstrate the potential success of commercial property investment in Malaysia, here are two case studies:

-

Case Study 1: Investor X acquired an office building in a prominent business district at an early stage of development. Over time, as the area attracted more businesses and witnessed significant commercial growth, the value of the office building escalated considerably. Investor X secured long-term leases with reputed tenants, resulting in consistent rental income and substantial capital appreciation upon selling the property.

-

Case Study 2: Investor Y invested in a retail property strategically located in a popular tourist destination. Due to the consistent flow of tourists and a vibrant local economy, the retail property experienced high occupancy rates and substantial rental income. The value of the property also increased significantly due to the demand for retail spaces in the area, providing Investor Y with excellent returns on investment.

These case studies highlight the potential rewards of commercial property investment in Malaysia and underscore the importance of understanding market dynamics, selecting the right location, and adopting a long-term investment approach.

In conclusion, commercial property investment in Malaysia offers investors a unique opportunity to diversify their portfolios and achieve substantial returns. By considering key factors such as location, market demand, and the tenant profile, investors can capitalize on the country’s growing business sector. While commercial property investment involves risks and complexities, thorough research, professional advice, and a long-term perspective can help investors navigate challenges and maximize their chances of success.